In today's digital age, convenience is king when it comes to managing our finances. One such convenience is the ability to set up recurring payments on our debit cards. Whether it's for monthly subscriptions, utility bills, or loan repayments, recurring payments offer a hassle-free way to ensure timely payments without the need for constant manual intervention.

However, understanding and managing recurring payments on your debit card is crucial to avoid any potential financial pitfalls. In this blog post, we will delve into the world of recurring payments, exploring how they work, their benefits and drawbacks, and most importantly, how to set them up and manage them effectively.

We will start by unraveling the mystery behind recurring payments – what they are and how they function on debit cards. We will discuss the advantages of setting up recurring payments, such as saving time and avoiding late fees. At the same time, we will also address the potential drawbacks, including the risk of overspending and the difficulty of cancellation.

Next, we will guide you through the process of setting up recurring payments on your debit card. From understanding the necessary information you need to provide, to navigating the online platforms or contacting the service providers, we will ensure you have all the necessary steps at your fingertips.

Managing recurring payments is equally important, and we will provide you with tips and strategies to keep track of your payments, avoid any unexpected surprises, and ensure that you have sufficient funds in your account. We will also address the scenario of switching your recurring payments to a new debit card, making the transition seamless and stress-free.

Of course, no payment system is without its flaws, and recurring payments are no exception. We will discuss the common issues that may arise with recurring payments and provide practical solutions to resolve them. From missed payments to incorrect charges, we've got you covered.

Moreover, we will share vital information on how to protect yourself and your money while using recurring payments. We will explore the security measures you can take to safeguard your financial information, steps to take if you become a victim of fraud or theft, and valuable tips for using recurring payments safely.

Understanding and managing recurring payments on your debit card may seem daunting at first, but with the right knowledge and practical guidance, you can master this essential aspect of modern finance. So, join us as we embark on this journey to empower you with the information and tools you need to make the most of recurring payments on your debit card. Stay tuned for our upcoming posts on this topic!

Introduction to Recurring Payments on Debit Cards

Recurring payments have revolutionized the way we handle our financial obligations. In this section, we will provide you with a comprehensive introduction to recurring payments on debit cards, shedding light on the concept and its significance in today's digital world.

To put it simply, recurring payments refer to the automatic and regular transactions made from your debit card to pay for goods or services on a predetermined schedule. These payments are typically used for ongoing expenses like subscriptions, memberships, utility bills, loan repayments, and more.

The rise of recurring payments can be attributed to the convenience they offer. Instead of manually making payments each month, you can set up automatic deductions from your debit card, saving you time and effort. This feature has become increasingly popular as more businesses embrace subscription-based models and customers seek seamless payment experiences.

Recurring payments on debit cards work by establishing an agreement between you (the cardholder) and the service provider or merchant. You provide your debit card details, authorize the provider to charge your card at regular intervals, and the payments are automatically deducted from your account on the agreed-upon dates.

The benefits of recurring payments are numerous. They ensure timely payments, minimizing the risk of late fees or service disruptions. By automating your payments, you can also simplify your financial management, as you don't have to remember multiple due dates or manually initiate transactions. Additionally, recurring payments can provide peace of mind, knowing that your bills are being taken care of effortlessly.

However, it is essential to be aware of the potential drawbacks of recurring payments. One challenge is keeping track of your expenses, as automatic deductions may lead to overspending or difficulty in budgeting. Additionally, canceling or modifying recurring payments can sometimes be a cumbersome process, requiring communication with service providers or navigating online platforms.

Understanding the fundamentals of recurring payments on debit cards is crucial for effectively managing your finances. In the following sections, we will delve deeper into the mechanics of recurring payments, the steps involved in setting them up, and strategies for managing and troubleshooting any issues that may arise. So, let's dive in and discover the intricacies of managing recurring payments on your debit card!

Understanding How Recurring Payments Work

To effectively manage recurring payments on your debit card, it's crucial to have a solid understanding of how they work. In this section, we will explore the mechanics behind recurring payments, including what they are, how they function on debit cards, and the benefits and drawbacks associated with this payment method.

What are Recurring Payments?

Recurring payments, also known as automatic payments or standing orders, are pre-authorized transactions that occur on a regular basis. They involve an agreement between you (the cardholder) and the service provider, allowing them to automatically deduct funds from your debit card at predetermined intervals. These intervals can be monthly, quarterly, annually, or any other agreed-upon frequency.

How Do Recurring Payments Function on Debit Cards?

When you set up a recurring payment on your debit card, you provide the necessary information to the service provider. This typically includes your debit card number, expiration date, and security code. You may also need to provide additional details such as your billing address or account number, depending on the specific requirements of the provider.

Once the information is submitted and verified, the service provider securely stores your card details, typically using industry-standard encryption protocols to protect your sensitive information. At the agreed-upon intervals, the provider automatically initiates a transaction, debiting the specified amount from your debit card. The funds are then transferred to the provider's account, completing the payment process.

Benefits and Drawbacks of Recurring Payments

Recurring payments offer several advantages that make them appealing to many individuals. One significant benefit is the convenience they provide. By automating your payments, you eliminate the need to manually initiate transactions each time a payment is due. This saves you time and effort, especially for recurring expenses like rent or utility bills.

Another advantage is the assurance of timely payments. With recurring payments, you can avoid late fees, penalties, or service disruptions that may occur due to missed or delayed payments. This can help you maintain a good credit history and ensure the continuity of essential services.

However, it's essential to be aware of the potential drawbacks associated with recurring payments. One challenge is the risk of overspending or losing track of your expenses. Since payments are automatically deducted, it can be easy to overlook the cumulative impact on your budget. It's crucial to regularly review your recurring payments to ensure they align with your financial goals and priorities.

Additionally, canceling or modifying recurring payments can sometimes be a complex process. Depending on the service provider, you may need to communicate your request in advance, adhere to specific cancellation policies, or navigate through online platforms to make changes. It's important to understand the cancellation procedures and terms of service before setting up recurring payments to avoid any inconvenience in the future.

Now that we have a solid understanding of how recurring payments work and the pros and cons associated with them, let's proceed to the next section, where we will explore the process of setting up and managing recurring payments on your debit card.

Setting Up and Managing Recurring Payments

Setting up and managing recurring payments on your debit card requires careful planning and organization. In this section, we will provide you with a step-by-step guide on how to set up recurring payments, as well as tips for effectively managing them.

How to Set Up Recurring Payments

Identify the Services or Merchants: Start by identifying the services or merchants that offer the option of recurring payments. This could include utility providers, streaming services, gym memberships, insurance companies, loan providers, and more.

Gather Necessary Information: Collect all the necessary information you will need to set up recurring payments. This typically includes your debit card details, such as the card number, expiration date, and security code. Additionally, have any additional information required by the service provider, such as your billing address or account number.

Contact the Service Provider: Reach out to the service provider through their customer service channels or visit their website. Inquire about their recurring payment options and request the necessary forms or instructions for setting up automatic payments.

Complete the Authorization Forms: Fill out the authorization forms provided by the service provider accurately and completely. Ensure that all the information you provide is correct, as any errors may lead to payment failures or delays.

Review the Terms and Conditions: Take the time to carefully read and understand the terms and conditions associated with recurring payments. Pay attention to details such as payment amounts, frequency, any applicable fees, cancellation policies, and how to update your payment information if necessary.

Submit the Authorization Forms: Once you have completed the forms and reviewed the terms and conditions, submit the authorization forms to the service provider. This can typically be done electronically through their website or by mailing the forms to the provided address.

Confirm Setup and Test Payments: After submitting the authorization forms, confirm with the service provider that your recurring payments have been successfully set up. It's also a good idea to make a small initial payment to ensure that the system is functioning correctly and that your debit card is properly linked to the recurring payment.

Managing Recurring Payments on Your Debit Card

Regularly Review Your Payments: It's crucial to regularly review your recurring payments to ensure they align with your current needs and budget. Take some time to evaluate each payment and determine if it is still necessary or if there are any opportunities to reduce expenses.

Track Payment Dates: Keep track of the payment dates for each recurring payment. This will help you plan your finances and ensure that you have sufficient funds available in your account to cover the payments.

Maintain Adequate Funds: Ensure that you have enough funds in your account to cover the recurring payments. Set up reminders or notifications to alert you when payments are due, so you can transfer funds if needed to avoid any overdraft fees or payment failures.

Monitor Your Bank Statements: Regularly review your bank statements to verify that the recurring payments are being processed correctly. Check for any discrepancies or unauthorized charges and report them to your bank or the service provider immediately.

Update Payment Information When Necessary: If you need to update your debit card information or switch to a new card, promptly notify the service providers and provide them with the updated details. This will ensure uninterrupted payments and prevent any potential issues.

By following these steps and implementing effective management strategies, you can set up and manage recurring payments on your debit card with ease and confidence. In the next section, we will discuss the process of switching recurring payments to a new debit card and provide guidance on handling this transition smoothly.

Potential Issues with Recurring Payments and How to Solve Them

While recurring payments offer convenience and peace of mind, they can sometimes come with their fair share of issues. In this section, we will explore some common problems that may arise with recurring payments and provide practical solutions to resolve them.

Common Problems with Recurring Payments

Insufficient Funds: One of the most common issues is when there are not enough funds in your account to cover a recurring payment. This can result in payment failures, overdraft fees, or even service disruptions.

Payment Errors: Occasionally, errors can occur during the payment process, resulting in incorrect charges or duplicate payments. These errors may be caused by technical glitches, miscommunication between the service provider and the bank, or human error.

Unauthorized Charges: In some cases, you may notice unauthorized charges appearing as recurring payments on your debit card. This could be a result of fraudulent activity or a mistake by the service provider.

Difficulty in Canceling or Modifying Payments: Another issue that may arise is the difficulty in canceling or modifying recurring payments. Service providers may have specific procedures or cancellation policies that can make the process more complex than expected.

Resolving Issues with Recurring Payments

Insufficient Funds: To avoid insufficient funds, regularly monitor your account balance and ensure that you have enough funds available to cover recurring payments. Set up alerts or notifications to remind you of upcoming payments and transfer funds if necessary. If you anticipate a shortage of funds, contact the service provider in advance to discuss alternative payment arrangements.

Payment Errors: If you notice any payment errors, such as incorrect charges or duplicate payments, contact the service provider immediately. Provide them with the necessary details and any supporting documentation to rectify the issue. Additionally, notify your bank to ensure that they are aware of the error and can assist in resolving it.

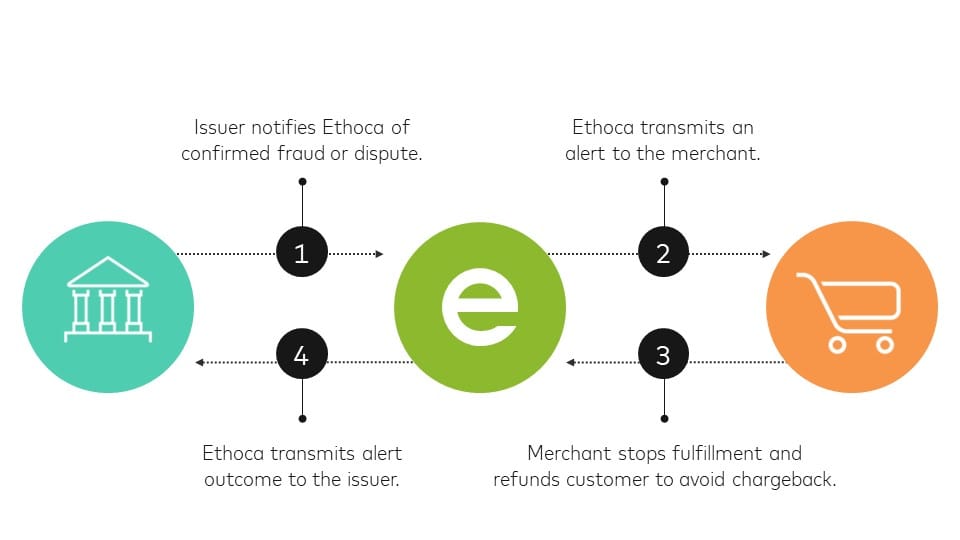

Unauthorized Charges: If you discover unauthorized charges appearing as recurring payments, act swiftly to protect your finances. Contact your bank to report the fraudulent activity and request a refund. They will guide you through the necessary steps to investigate the issue and secure your account. Simultaneously, notify the service provider about the unauthorized charges and request immediate cancellation of the recurring payment.

Difficulty in Canceling or Modifying Payments: If you encounter challenges in canceling or modifying recurring payments, refer to the terms and conditions provided by the service provider. Follow their specified procedures, which may include contacting their customer service department, submitting a written request, or accessing their online platform. Document all communication and keep records of your requests for future reference. If the issue persists, escalate the matter to higher-level support or seek assistance from your bank or a consumer protection agency.

By being proactive and addressing these potential issues promptly, you can ensure a smooth and hassle-free experience with your recurring payments. In the next section, we will discuss important measures to protect yourself and your money while using recurring payments on your debit card.

Protecting Yourself and Your Money While Using Recurring Payments

When using recurring payments on your debit card, it's crucial to prioritize the security and protection of your personal information and finances. In this section, we will discuss important measures to safeguard yourself and your money while utilizing recurring payments.

Security Measures for Recurring Payments

Choose Reputable Service Providers: Select trusted and reputable service providers when setting up recurring payments. Research their reputation, security measures, and customer reviews to ensure they have a strong track record of protecting customer information.

Verify Website Security: Before providing your debit card details, ensure that the service provider's website is secure. Look for the padlock icon in the website address bar, indicating that the site is encrypted and your information will be transmitted securely.

Use Strong and Unique Passwords: Create strong and unique passwords for your online payment accounts. Avoid using easily guessable information and consider using a password manager to securely store and generate complex passwords.

Enable Two-Factor Authentication: Utilize two-factor authentication whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

Regularly Monitor Your Accounts: Keep a close eye on your bank statements and transaction history to detect any suspicious activity. Report any unauthorized charges or discrepancies to your bank or card issuer immediately.

What to Do if You're a Victim of Fraud or Theft

Report Fraudulent Activity: If you believe you have become a victim of fraud or theft related to recurring payments, contact your bank or card issuer immediately. They can help you block your card, investigate the issue, and assist in recovering any lost funds.

Update Payment Information: If your debit card has been compromised, update your payment information with the affected service providers. This may involve contacting them directly or accessing their online platforms to make the necessary changes.

Monitor Credit Reports: Regularly monitor your credit reports to identify any unauthorized accounts or suspicious activities. Reporting these issues promptly can help mitigate the impact of identity theft and fraud.

Tips for Safe Use of Recurring Payments

Regularly Review Your Recurring Payments: Periodically review your recurring payments to ensure they are still necessary and align with your financial goals. Cancel any unnecessary subscriptions or services to avoid unnecessary charges.

Set Up Account Alerts: Enable account alerts and notifications from your bank to receive instant updates on any transactions or changes to your account. This will help you stay informed and quickly detect any unauthorized activity.

Educate Yourself on Scams and Phishing: Stay informed about common scams and phishing attempts targeting debit card users. Be cautious of suspicious emails, messages, or phone calls requesting personal information or payment details. Never provide sensitive information unless you are confident about the legitimacy of the request.

By implementing these security measures and staying vigilant, you can protect yourself and your money while using recurring payments on your debit card. Remember to stay informed about the latest security practices and be proactive in addressing any concerns or issues that may arise. With these precautions in place, you can enjoy the convenience and peace of mind that recurring payments offer.