In recent years, cryptocurrencies have revolutionized the way we think about money and financial transactions. The decentralized nature and security features of cryptocurrencies have made them an attractive option for various use cases, including payments. One area where cryptocurrencies have the potential to truly shine is in the realm of recurring payments.

Recurring payments, also known as subscription-based payments, are transactions that occur at regular intervals, such as monthly or annually. They are commonly used for services like streaming platforms, subscription boxes, and membership fees. Traditionally, these payments have been facilitated through traditional banking systems, but with the rise of cryptocurrencies, there is a new opportunity to explore the potential of recurring payments in the crypto space.

In this blog post, we will delve into the world of recurring payments in crypto and explore the benefits, challenges, and solutions that arise in this intersection. We will begin by providing an introduction to recurring payments and cryptocurrencies, highlighting their individual advantages. Then, we will examine the challenges posed by traditional recurring payments in the crypto space and the emergence of solutions tailored specifically for this purpose.

Security and privacy considerations are paramount when dealing with cryptocurrencies, and we will discuss the importance of these aspects in the context of recurring crypto payments. Additionally, the volatility and price fluctuations inherent in cryptocurrencies can pose challenges for recurring payments, but we will explore strategies to mitigate these risks, including the use of stablecoins.

One of the key enablers of recurring payments in the crypto space is the concept of smart contracts. We will explain what smart contracts are and how they can be leveraged to automate recurring payments, streamlining the process for both businesses and users. We will also discuss the benefits and challenges associated with smart contract-based recurring payments.

To help you navigate the world of recurring payments in crypto, we will provide an overview of popular platforms, payment gateways, processors, and wallets that support recurring crypto payments. This will give you a clear understanding of the options available and help you make informed decisions.

Furthermore, we will guide businesses on how to implement recurring payments into their existing models and provide best practices for accepting recurring crypto payments. From the user perspective, we will discuss how individuals can subscribe to recurring crypto payments and the factors to consider when choosing a recurring payment service.

Regulatory and legal considerations are also crucial in the crypto space, and we will provide an overview of the current regulatory landscape for recurring crypto payments and the compliance requirements for businesses and users.

Lastly, we will explore future trends and the potential evolution of recurring payments in the crypto space. We will discuss emerging technologies that may impact recurring crypto payments and the opportunities and challenges that lie ahead. In the conclusion, we will recap the key points covered in the blog post and offer our final thoughts on the future of recurring payments in the crypto world.

Join us on this journey as we unleash the power of crypto and unlock the potential of recurring payments. Whether you are a business owner, a crypto enthusiast, or simply curious about the intersection of cryptocurrencies and recurring payments, this blog post will provide valuable insights and perspectives. Let's dive in and explore the exciting possibilities that await us!

Introduction to Recurring Payments in Crypto

Recurring payments have become an integral part of our daily lives, enabling us to effortlessly access various services and products on a subscription basis. From streaming platforms like Netflix to subscription boxes filled with curated goodies, recurring payments offer convenience and hassle-free access to the things we love. However, the traditional landscape of recurring payments has faced its fair share of challenges, including high transaction fees, lengthy settlement periods, and limited global accessibility.

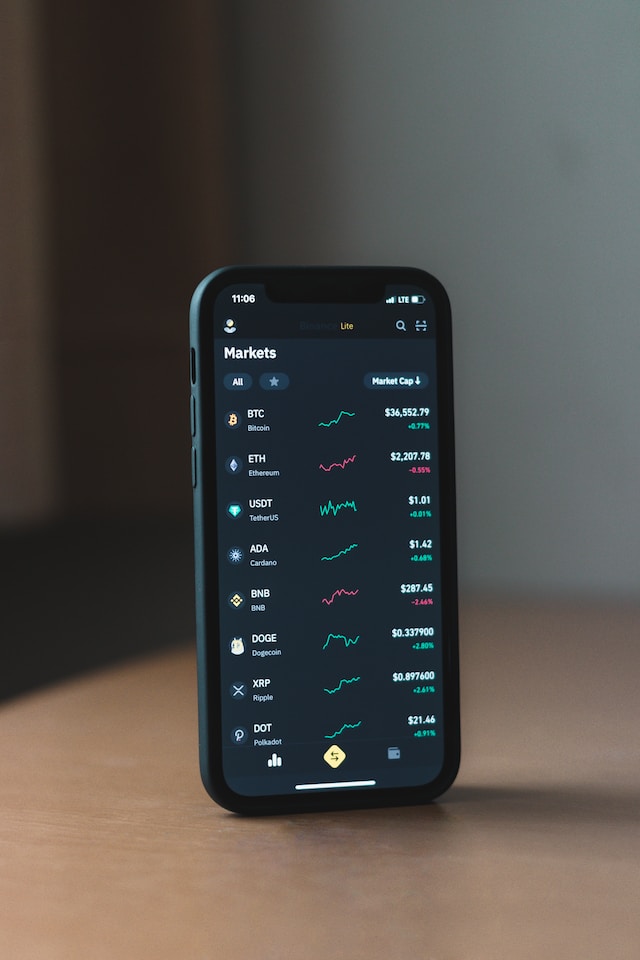

The advent of cryptocurrencies has introduced a new paradigm for recurring payments, offering a potential solution to the limitations of traditional payment systems. Cryptocurrencies, such as Bitcoin, Ethereum, and Ripple, are digital assets that utilize strong cryptography to secure transactions and control the creation of additional units. With their decentralized nature and advanced encryption techniques, cryptocurrencies have gained popularity as an alternative form of payment, providing a range of advantages over traditional fiat currencies.

One of the key advantages of cryptocurrencies in the context of recurring payments is the elimination of intermediaries, such as banks and payment processors. Traditional recurring payment systems often involve multiple intermediaries, resulting in higher transaction fees and slower settlement times. In contrast, cryptocurrencies enable direct peer-to-peer transactions, reducing costs and increasing transaction speed.

Moreover, cryptocurrencies offer enhanced security and privacy features compared to traditional payment systems. The cryptographic nature of cryptocurrencies ensures the integrity and immutability of transactions, making them highly resistant to fraud and tampering. Additionally, cryptocurrencies provide users with greater control over their personal information, as transactions can be conducted pseudonymously, protecting sensitive data from potential breaches.

The intersection of recurring payments and cryptocurrencies presents exciting opportunities and challenges. On one hand, leveraging cryptocurrencies for recurring payments can enhance user experience, reduce costs, and provide access to a wider global market. On the other hand, there are challenges that need to be addressed, such as price volatility, security considerations, and the need for automation and smart contract-based solutions.

In the following sections of this blog post, we will delve deeper into the challenges and solutions for recurring payments in the crypto space. We will explore the security and privacy considerations when dealing with cryptocurrencies, strategies to mitigate price volatility risks, and the role of smart contracts in automating recurring payments. Additionally, we will examine popular platforms, payment gateways, processors, and wallets that facilitate recurring crypto payments. Furthermore, we will discuss the implementation of recurring payments in both business and user perspectives, while considering the regulatory and legal landscape surrounding these transactions.

Join us as we embark on this journey to uncover the potential of recurring payments in the crypto world. Through comprehensive exploration and analysis, we aim to provide you with valuable insights and practical knowledge to navigate the exciting realm of recurring payments in the crypto space. Let's dive in and discover the future of seamless, secure, and efficient recurring payments with cryptocurrencies.

Challenges and Solutions for Recurring Payments in Crypto

The intersection of recurring payments and cryptocurrencies brings forth a unique set of challenges that need to be addressed in order to ensure a seamless and secure payment experience. In this section, we will explore the key challenges faced in recurring payments with cryptocurrencies and discuss potential solutions to overcome them.

Security and Privacy Considerations

When dealing with cryptocurrencies, security and privacy are of paramount importance. While cryptocurrencies offer robust security features, it is crucial to take additional precautions to protect recurring payment transactions. The decentralized and immutable nature of blockchain technology ensures the integrity of transactions, but it is essential to safeguard the private keys associated with crypto wallets to prevent unauthorized access.

To enhance security in recurring crypto payments, it is advisable to use hardware wallets or secure software wallets that offer advanced security features. These wallets store private keys offline, reducing the risk of theft or hacking. Additionally, implementing multi-factor authentication and encryption protocols adds an extra layer of security to protect user funds and sensitive information.

Privacy is another aspect to consider when conducting recurring payments with cryptocurrencies. While blockchain transactions are transparent and can be traced, the pseudonymous nature of cryptocurrencies allows users to maintain a certain level of privacy. However, it is important to note that transactions conducted with certain cryptocurrencies, like Bitcoin, can still be linked to the user's identity through careful analysis.

To address privacy concerns, several privacy-focused cryptocurrencies have emerged, such as Monero and Zcash, which offer enhanced privacy features like ring signatures and zero-knowledge proofs. These cryptocurrencies provide users with the option to conduct truly anonymous transactions, ensuring the confidentiality of their recurring payment activities.

Volatility and Price Fluctuations

One of the significant challenges in recurring payments with cryptocurrencies is the inherent volatility and price fluctuations associated with these digital assets. The value of cryptocurrencies can experience significant changes within short periods, making it challenging to determine the exact amount to be deducted for each recurring payment cycle.

To mitigate the risks associated with price fluctuations, one solution is to utilize stablecoins for recurring payments. Stablecoins are cryptocurrencies that are pegged to a stable asset, such as a fiat currency or a commodity. These stablecoins aim to maintain a stable value, reducing the impact of price volatility on recurring payments. By using stablecoins as the medium of exchange for recurring payments, businesses and users can enjoy the benefits of cryptocurrencies while minimizing the risks associated with price fluctuations.

Another strategy to address volatility is to use payment processors or platforms that offer real-time conversion of cryptocurrencies into fiat currencies at the time of the transaction. This approach allows businesses to receive stable fiat currency payments, regardless of the cryptocurrency used for the recurring payment. It provides stability and certainty for businesses, ensuring predictable revenue streams.

Smart Contracts and Automation

Smart contracts, a fundamental concept in blockchain technology, can play a crucial role in automating recurring payments with cryptocurrencies. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce the agreed-upon terms, eliminating the need for intermediaries and manual intervention in recurring payment transactions.

By leveraging smart contracts, businesses can streamline the process of recurring payments. Once the terms of the subscription are established, the smart contract can automatically execute the payment at the designated intervals, without requiring the user or the business to initiate the transaction manually. This automation eliminates the risk of missed payments and reduces administrative overhead.

However, it is important to note that the implementation of smart contracts for recurring payments requires careful consideration of the contract terms, payment intervals, and cancellation policies. Additionally, smart contracts should be audited and thoroughly tested to ensure their security and accuracy. Nevertheless, when properly implemented, smart contracts offer a reliable and efficient solution for recurring payments in the crypto space.

In the next section, we will explore popular platforms and tools that facilitate recurring payments with cryptocurrencies, providing businesses and users with a range of options to choose from. We will examine the features, functionalities, and advantages of these platforms, empowering you to make informed decisions when it comes to implementing recurring payments in the crypto world.

Popular Platforms and Tools for Recurring Payments in Crypto

In the ever-evolving landscape of cryptocurrencies, numerous platforms and tools have emerged to facilitate recurring payments with digital assets. These platforms offer businesses and users the convenience and flexibility to incorporate cryptocurrencies into their subscription-based models. In this section, we will explore some of the popular platforms and tools available for recurring payments in the crypto space.

Overview of Recurring Payment Platforms

Recurring payment platforms specifically tailored for cryptocurrencies provide businesses with a comprehensive solution to seamlessly integrate recurring payments into their operations. These platforms offer a range of features, including subscription management, payment processing, and automated billing.

One such platform is MoonClerk, which allows businesses to set up recurring payments and subscriptions with cryptocurrencies. MoonClerk offers a user-friendly interface and supports various cryptocurrencies, enabling businesses to offer their customers the option to pay with their preferred digital asset.

Another popular platform is CoinGate, which provides businesses with a payment gateway solution for accepting cryptocurrencies. CoinGate offers a recurring payments feature that simplifies the process of setting up and managing recurring payments, allowing businesses to automate their subscription-based services.

Payment Gateways and Processors

Payment gateways and processors play a crucial role in facilitating recurring payments with cryptocurrencies. These intermediaries handle the transaction process, ensuring the secure transfer of funds between the payer and the payee.

Coinbase Commerce, the payment processing arm of the well-known cryptocurrency exchange Coinbase, offers a recurring payments feature that enables businesses to accept recurring crypto payments. With Coinbase Commerce, businesses can set up recurring payment plans, customize billing intervals, and automate the collection process.

BitPay, another leading payment gateway, allows businesses to accept recurring payments in cryptocurrencies. BitPay supports various cryptocurrencies and offers features such as invoicing, billing automation, and subscription management, making it a popular choice for businesses looking to integrate recurring payments into their operations.

Wallets and Apps for Recurring Payments

Cryptocurrency wallets and apps also play a significant role in facilitating recurring payments. These wallets provide users with a secure and convenient way to store, manage, and transact with their digital assets.

Exodus, a popular multi-currency wallet, offers a recurring payments feature that allows users to set up and manage recurring transactions with cryptocurrencies. With Exodus, users can schedule regular payments, ensuring seamless and automated recurring payments for their subscriptions or services.

Another notable wallet is Trust Wallet, which supports a wide range of cryptocurrencies and provides users with the ability to set up recurring payments. Trust Wallet offers a simple and intuitive interface, making it easy for users to manage their recurring payments with cryptocurrencies.

These are just a few examples of the many platforms, payment gateways, processors, and wallets available for recurring payments in the crypto space. It is important for businesses and users to explore and evaluate the features and functionalities offered by these platforms to choose the one that best suits their needs.

In the next section, we will delve into the process of implementing recurring payments in crypto, providing businesses with guidance on integrating recurring payments into their existing models. We will also discuss the user perspective and the factors individuals should consider when subscribing to recurring crypto payments. Additionally, we will explore the regulatory and legal considerations surrounding recurring payments with cryptocurrencies. Stay tuned to gain a comprehensive understanding of the practical aspects of recurring payments in the crypto world.

Implementing Recurring Payments in Crypto

Implementing recurring payments in the crypto space involves careful planning and integration to ensure a seamless and efficient process. In this section, we will provide guidance for businesses looking to integrate recurring payments into their existing models and explore the user perspective when subscribing to recurring payments with cryptocurrencies. Additionally, we will discuss the regulatory and legal considerations surrounding recurring payments in the crypto world.

Setting up Recurring Payments for Businesses

For businesses, integrating recurring payments with cryptocurrencies requires a systematic approach to ensure a smooth transition and optimal user experience. Here are some steps to consider when implementing recurring payments:

Choose a suitable payment gateway or processor: Select a reliable payment gateway or processor that supports recurring payments with cryptocurrencies. Consider factors such as transaction fees, supported cryptocurrencies, and integration options.

Define subscription plans: Determine the subscription plans you want to offer and set the pricing, billing intervals, and duration for each plan. Consider offering various tiers or options to cater to different customer preferences.

Integrate the payment gateway: Integrate the chosen payment gateway or processor into your existing website or application. Ensure that the integration is seamless and user-friendly, allowing customers to easily subscribe and manage their recurring payments.

Implement smart contract automation: If using smart contracts for recurring payments, develop and deploy the necessary smart contracts to automate the payment process. Test and audit the smart contracts to ensure their security and accuracy.

Communicate with customers: Clearly communicate the availability of recurring payment options and the benefits to your customers. Provide clear instructions on how to subscribe, manage, and cancel recurring payments.

Monitor and optimize: Continuously monitor the performance of your recurring payments system, including transaction success rates, customer feedback, and any issues that arise. Optimize the process based on feedback and make necessary adjustments to ensure a seamless experience for customers.

User Perspective: Subscribing to Recurring Payments

From a user perspective, subscribing to recurring payments with cryptocurrencies offers convenience and flexibility. Here are some factors to consider when choosing a recurring payment service:

Supported cryptocurrencies: Check if the recurring payment service supports the cryptocurrencies you prefer to use. Ensure that the service allows flexibility in terms of cryptocurrency options, allowing you to pay with your preferred digital asset.

Security and privacy: Prioritize services that prioritize security measures, such as two-factor authentication and encryption, to protect your funds and personal information. Consider services that offer enhanced privacy features to safeguard your identity and transaction history.

User-friendly interface: Opt for services with intuitive and user-friendly interfaces that make it easy to subscribe, manage, and cancel recurring payments. A seamless user experience ensures a hassle-free and enjoyable payment process.

Transparent pricing: Look for services that provide transparent pricing and clearly communicate any fees associated with recurring payments. Ensure that you understand the costs involved to make informed decisions.

Flexibility and customization: Consider services that offer flexibility in terms of billing intervals, payment options, and the ability to customize your recurring payment plans. This allows you to tailor the service to your specific needs and preferences.

Regulatory and Legal Considerations

When dealing with recurring payments in the crypto space, it is important to be aware of the regulatory and legal landscape. The regulatory framework surrounding cryptocurrencies and recurring payments varies across jurisdictions. Some key considerations include:

AML and KYC Compliance: Ensure that your business complies with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Implement robust identity verification processes to mitigate the risk of illicit activities and comply with relevant regulations.

Taxation: Understand the tax implications of recurring payments with cryptocurrencies. Consult with relevant tax authorities or professionals to ensure compliance with tax regulations and reporting requirements.

Data Protection and Privacy: Safeguard customer data and ensure compliance with data protection and privacy regulations, such as the General Data Protection Regulation (GDPR). Implement security measures to protect customer information from unauthorized access or breaches.

Legal Agreements: Establish comprehensive terms of service and privacy policies that outline the rights and obligations of both the business and the customer. Clearly communicate the terms and conditions associated with recurring payments, cancellation policies, and refund procedures.

By considering and adhering to the regulatory and legal requirements, businesses and users can ensure compliance and build trust in the recurring payment process.

In the next section, we will explore the future trends and potential developments in recurring payments with cryptocurrencies. We will discuss emerging technologies and their impact on this space, as well as the opportunities and challenges that lie ahead. Stay tuned to gain insights into the exciting future of recurring payments in the crypto world.

Future Trends and Conclusion

The world of recurring payments in the crypto space is constantly evolving, driven by advancements in technology and changing market dynamics. In this section, we will explore the potential future trends and developments in recurring payments with cryptocurrencies. We will also discuss the opportunities and challenges that lie ahead.

Evolution of Recurring Payments in Crypto

As cryptocurrencies continue to gain mainstream acceptance, the adoption of recurring payments in the crypto space is expected to increase. One potential trend is the integration of recurring payments into decentralized finance (DeFi) platforms. DeFi platforms leverage blockchain technology to offer a wide range of financial services, including lending, borrowing, and yield farming. Integrating recurring payments into DeFi platforms would enable users to subscribe to various DeFi services and products on a recurring basis, further expanding the use cases for cryptocurrencies.

Another emerging trend is the development of cross-chain interoperability solutions. Currently, most recurring payment platforms and tools are specific to a particular blockchain or cryptocurrency. However, with the rise of cross-chain interoperability protocols, users may be able to subscribe to recurring payments using different cryptocurrencies across multiple blockchain networks seamlessly. This would enhance flexibility and accessibility for users, allowing them to utilize their preferred cryptocurrencies for recurring payments.

Furthermore, the integration of decentralized identity solutions with recurring payments could enhance the security and privacy of transactions. Decentralized identity systems enable users to have control over their personal information and selectively share it with service providers. By incorporating these identity solutions, recurring payment platforms can ensure stronger user authentication and data protection, further enhancing the trust and security of recurring payments in the crypto world.

Opportunities and Challenges

The growth of recurring payments in the crypto space presents numerous opportunities for businesses and users alike. For businesses, recurring payments offer a predictable revenue stream and improved cash flow. Integrating cryptocurrencies into recurring payments allows businesses to tap into a global market, reaching customers who prefer to transact with digital assets. Furthermore, cryptocurrencies enable micropayments, opening up new possibilities for subscription-based models with low-cost products or services.

For users, recurring payments with cryptocurrencies offer convenience and flexibility. With the increasing acceptance of cryptocurrencies, individuals can enjoy the benefits of seamless and automated payments across a wide range of services, from streaming platforms to software subscriptions. Cryptocurrencies also provide users with greater control over their financial transactions, offering the potential for enhanced privacy and security.

However, there are challenges that need to be addressed to fully realize the potential of recurring payments in the crypto space. Price volatility remains a significant hurdle, as the fluctuating value of cryptocurrencies can impact the cost of recurring payments. Stablecoins and real-time conversion solutions play a crucial role in mitigating this challenge, providing stability and certainty in recurring payments.

Additionally, regulatory and legal considerations continue to evolve in the crypto space. As governments around the world develop frameworks for cryptocurrencies and recurring payments, businesses and users must stay informed and comply with the applicable regulations. Collaboration between industry stakeholders and regulatory bodies is essential to ensure a conducive environment for the growth of recurring payments in the crypto world.

Conclusion

In conclusion, recurring payments in the crypto space offer exciting opportunities for businesses and users to leverage the benefits of cryptocurrencies in subscription-based models. With enhanced security, privacy features, and automation through smart contracts, cryptocurrencies provide a unique value proposition for recurring payments. Platforms, payment gateways, and wallets tailored for recurring payments in crypto offer businesses and users the tools and infrastructure to seamlessly integrate cryptocurrencies into their operations.

While there are challenges to overcome, such as price volatility and regulatory considerations, the ongoing advancements in technology and the growing acceptance of cryptocurrencies pave the way for a promising future of recurring payments in the crypto world. By staying informed, embracing innovation, and complying with regulations, businesses and users can navigate this evolving landscape and unlock the full potential of recurring payments with cryptocurrencies.

Thank you for joining us on this journey through the realm of recurring payments in crypto. We hope this comprehensive exploration has provided valuable insights and practical knowledge to navigate the exciting world of cryptocurrencies and recurring payments. Embrace the possibilities, adapt to the changes, and embrace the future of seamless, secure, and efficient recurring payments in the crypto space.